The choice between real estate and stock markets is dictated by choice, personality, and risk appetite. There are only a few stocks that can beat the appreciation of prime property and no amount of real estate investment can compete with an early-bird investment of blue-chip stocks.

Preferring Real Estate Investment to Investment in the Stock Market

Real estate requires a lot of research and is an asset that cannot be readily liquidated into cash. Some real estate is a cash-generating like apartment buildings, rental houses, and strip malls. This is a much more comfortable investment for lower and middle classes as they are more exposed to this kind of investment. Rents provide an important source of cash flow every month and therefore improve the amount of cash in the long run.

The chances of fraud are minimal within real estate as owners can physically inspect the property for damages and repairs. The availability of home loans grants landlords an opportunity to invest within structured debt for appreciation.

Property has been a significant hedge against inflationary pressures in an economy and therefore safeguards money against inflation. Owning a tangible asset can grant more control through its investment.

Real estate provides some tax benefits as income derived from real estate is not subject to income tax. Rent provides an income shield against mortgage payments. Dividends from stock are uncertain as compared to rental income that is fixed for the duration of time.

The prices of real estate property appreciate over some time and have an intrinsic value from which it cannot fall. Real estate provides an excellent method to use borrowed capital to accelerate the number of holdings in the same sector. This is the most common method of using leveraged funds.

Responsible investment in real estate improves community standards by improving housing availability, maintaining the property, and increasing local tax revenue. Repairing and maintaining dilapidated housing enhances the self-esteem of neighbors and other rentals in an area.

This field provides an excellent route for entrepreneurship and real estate companies foster some kind of business spirit between tenants and landowners. Real estate grants people an opportunity to monetize property through its rent, lease, or sale. Real estate investment can be partial, and all potential costs can be dispersed unto loans.

Preferring Investment in Stocks to Real estate

Buying stocks and reinvesting its dividends generates wealth over a long period. Stocks are a liquid form of investment and are purchased or sold at ease as compared to real estate. Share purchases grant a small part of the ownership of a company. How stock market works in India is detailed concept in itself so we won’t get in that.

Diversification of stock portfolios is more accessible in the stock market as compared to real estate investment. A transaction fee within stock markets is significantly cheaper than real estate transaction costs.

Stocks provide dividends; these are a portion of a company’s earnings distributed to all shareholders. Stock ownership does not generate any kind of workload for shareholders. The amount of capital required for investing within stocks is significantly lesser than real estate.

Real estate requires more massive amounts for initial investment, and all company ownership bought and sold from stocks can as little as a single share.

Share ownership grants voting rights to holders at annual general meetings and also grants control at a majority share. Purchases are made at ease by opening up a brokerage account. Stocks markets facilitate buying and selling stocks and make transactions convenient for shares. This form of investment grants capital appreciation as a potential return for investment.

Share ownership carries limited liability, and therefore holders are protected from the financial obligations of a share and liable to the shares face value. Common stocks are a crucial means for companies to raise capital for expansion.

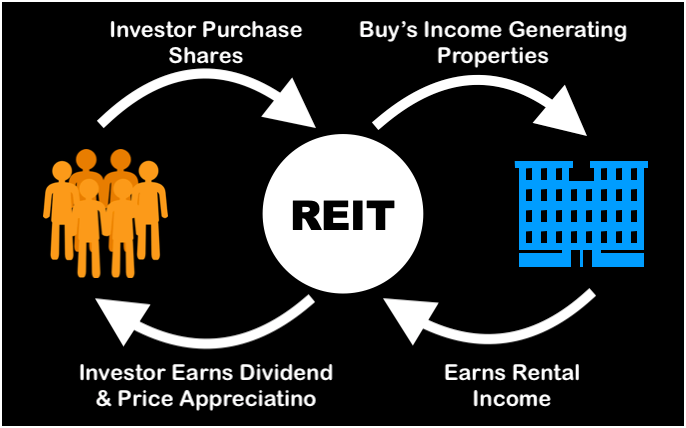

Substitute for traditional real estate – REIT (Real Estate Investment Trusts)

A real estate investment trust (REIT) is a company that holds, finances, and operates properties to generate income. This can generate a steady stream of income for investors but offer little capital appreciation.

Most REITs are publicly traded stocks and are considered highly liquid investments. Apartments, data centers, healthcare facilities, and hotels are traditional properties held at REIT portfolios. REITs can earn rental income, management fees, and mortgage income. This tends to focus on a particular segment of properties and leads to specific types of companies.

A lease is a contract between an owner and user of a property that lasts for twelve months or more. Both a landlord and lessee can sign an agreement that grants the right to operate a business on the property in exchange for some compensation. There are different types of leases available for investments. This concept is different from rent as rental agreements only last for a month.

Fix and Flip Strategy refers to a strategy of purchasing property and then renovating it with anticipation of profit. Investors buy property at a discounted rate due to its conditions of disrepair and invest in its upkeep and repairs.

Real estate wholesaling refers to the practice of contracting home with a seller then finding interested parties to buy the home. This kind of seller generally finds distressed clients for contracts and puts their properties for sale.