An investment decision backed by educated insights often helps us to achieve our aspirations. A majority of the investors in the market have a portfolio with diversified assets such as government schemes, bonds, gold, and stocks. However, the extremely underrated and neglected investment asset, in today’s times, remains the real estate.

Owing to increased economic growth, the average income of citizens residing in cities has increased drastically. This has given a boost to the demand for real estate, and this demand is expected to grow significantly soon. Such a scenario has allowed investors to invest in real estate today, to reap benefits tomorrow. However, many investors are still unknown to the workings of real estate and its benefits as an investment vehicle.

Real estate investment in India is often considered to be a scarce resource and is a hard asset. Investment in commercial property in such a scenario can be extremely good for the long-term. Investment in commercial property has an intrinsic value associated with it, which appreciates over a certain period.

Unlike publicly-traded securities and the involved volatility of public investments, direct investment in real estate can provide steady cash flow in the form of rental income. Having real estate in one’s investment portfolio can have advantages such as portfolio diversification, long-term appreciation, and net cash flow. We at MyFollo have amazing offers for HNI investment options in India.

Table of Contents

Pros of investing in the Real Estate

We all are aware of the possible financial benefits we might receive from investing in real estate. There are many benefits to investing in real estate that outweigh the risks, and you, as an investor, will gain a steady flow of income to ensure long haul financial independence. If you back your investments with well thought out real estate investment strategies, the benefits of it will help you reap attractive returns. Here are some of the pros of investing in the real estate sector:

- Steady Income

A steady income is one of the most prominent benefits of investing in the real estate sector. Depending on the location of your real estate investment, you can earn significant returns over a specific period.

- Long-term Financial Security

When you invest in real estate, you ensure a steady flow of cash for a long duration. This investment thus enables you to gain financial rewards for a long time. The main aim of investing is to be financially able and have long-term financial security. An investment in real estate helps you achieve just that.

- Tax Benefits

Tax benefits are one of the most alluring advantages of investing in real estate. For example, the self-employment tax in India is not levied on rental income. Moreover, the government offers relaxation for property taxes, legal fees, travel expenses, maintenance repairs, insurance, and property depreciation. And the icing on the cake is that investors are subjected to lower tax rates for long-term investment in real estate.

- High Appreciation

Investing in real estate is not for the short term since the benefits of this investment are often realized in the long-term. Real estate investment usually appreciates over time, thus increasing its resale value. In other words, the value of the property that you have invested in today will increase multiple folds by the next 10 years.

Why should HNI invest in real estate?

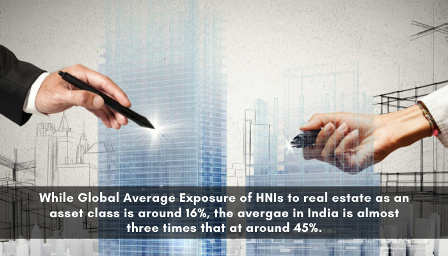

High net-worth individuals (HNIs) should consider investing more in real estate as compared to other asset classes. Different asset classes such as equity are more prone to volatility, and hence many times fail to give attractive returns.

The high appreciation of their investment often guides HNI investment in real estate in abundance as compared to that of a small investor, and can keep a portion of their funds locked in an investment for a longer duration, they should invest in real estate. HNIs should formulate strong real estate investment strategies and aim to achieve attractive returns shortly.

HNI investment options in India are attractive, such as residential and commercial properties, which have the potential to generate attractive returns. For HNI’s, investment in real estate would yield more stable returns and would help them increase their investment value multiple folds over time.

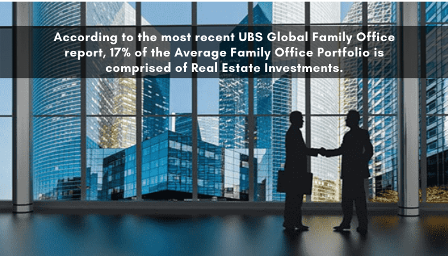

Why should family offices invest in real estate?

A family office is a privately owned business that manages financial services and asset management for an affluent family, intending to build and distribute wealth successfully through generations.

Many are often confused as to how do family offices invest. The sole purpose of a family office is to manage investments to sustain long-term prosperity and wealth. Investment by family offices can be either in variable income-generating assets or real estate.

In the current times of extreme market volatility, real estate investment for family offices has proven to be a boon. Family offices should increase their investments in stable assets such as real estate, to ensure sustained growth over the long-term. Given the comparatively low association with the capital markets, investment in real estate for family offices is ideally. Suitable for diversifying their equity, debt, and other alternatives portfolios.

Wealthy families often have an objective to preserve value rather than to aim for appealing returns. Hence, family offices have a crucial goal to safeguard a sound legacy for their client’s future generations. Real estate investment, in such a scenario, helps family offices achieve the desired preservation of value.

Both HNIs and family offices have a common desire to separate certain assets from their main business line and safeguard them to build a long-term value-appreciating asset. Real estate investment, in this case, is the right path to venture on, for both HNIs and family offices, to create sustained growth.

HNIs and family offices need to formulate strong operations and strategies for indirect or direct investment in real estate. Formulating a definite plan is extremely important since it will take numerous aspects under consideration, such as diversification, returns, risk, and control.

Investors should be careful while opting for indirect real estate investment, as it gives limited flexibility, in the event of changes investor preferences or fund strategies. Direct investment in real investment offers better control, and investors can decide for themselves. In any case, conducting thorough research is a must and can help in generating sustained returns over time.

16 thoughts on “Why High Net Worth Individuals (HNIs) and Family Offices should invest in Indian real estate market?”

Comments are closed.